A balance sheet must be an accurate statement of the assets and liabilities, as well as the capital of a firm, organization or business within a specific time period. It has to have the complete details of the balance of expenditure and income over the preceding period of time.

Learn simple steps on how to create a balance sheet for accounting:

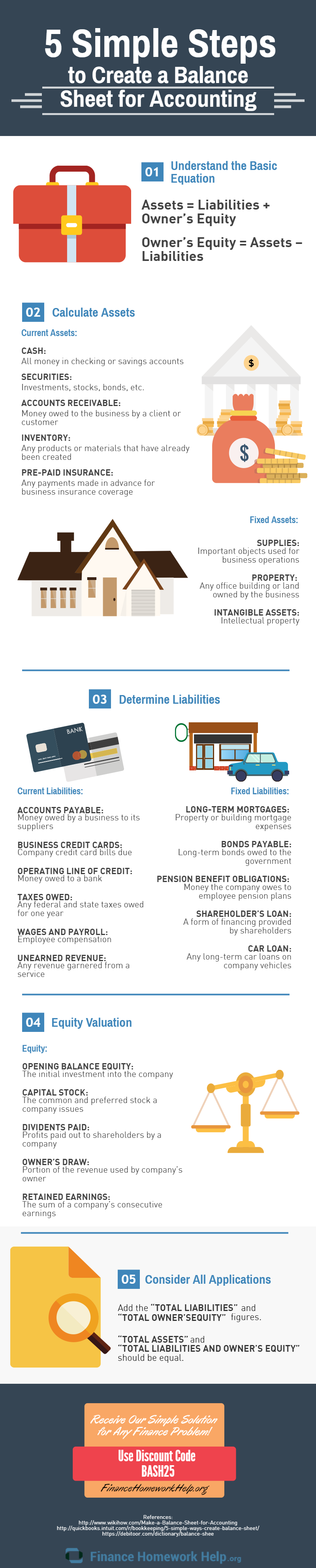

- Understand the basic equation, and it is Assets=Liabilities + Owner’s Equity; Owner’s Equity = Assets Liabilities.

- Calculate assets. What are these? Samples include cash, securities, accounts receivable, inventory, pre-paid insurance, and fixed assets include supplies, property and intangible assets.

- Determine liabilities. What are the current liabilities (accounts payable, business credit cards, operating line of credit)? What are the fixed liabilities (long-term mortgage, bonds payable and pension benefit obligations)?

- Find the equity valuation. What is the opening balance equity, capital stock, owner’s draw and retained earnings?

- Consider all the applications. Saying this means that you need to add the total liabilities and the total owner’ equity figures. You also need to add the total assets, and then the total liabilities and owner’s equity, which have to be equal.

However, it might be easier said than done to complete a financial balance sheet, as well as make sure it is accurate. Not all people can come up with a correct accounting sheet, which is why they hire accountants and other experts for finance homework help. Now before you become that expert where these firms or companies would get help from in the future, you must learn for yourself ways on how to do it correctly, too. This is the exact same reason your professor is assigning you balance sheet homework from time to time.