What is the CAPM model?

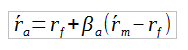

Investors want a rate of return that compensates them for taking on risk. The capital asset pricing model (CAPM) helps to calculate investment risk and what return should be expected. The model begins with the idea that individual investment has both systematic risk and unsystematic risk. Systematic risks are those that cannot be diversified away such as interest rates and wars. Unsystematic risks are specific to individual stocks and can be diversified away by increasing the number of stocks in an investor’s portfolio. The capital asset pricing model evolved as a way to measure systematic risk. CAPM describes the relationship between risk and expected return. The formula is:

In the formula ![]() = required return on security,

= required return on security, ![]() = risk-free rate of return,

= risk-free rate of return, ![]() = beta of the security and

= beta of the security and ![]() = Equity market premium.

= Equity market premium.

According to CAPM the only relevant measure of a stock’s risk is beta. It measures a stock’s relative volatility. In other words it shows how much the price of a particular stock goes up and down in relation to the movement of the market as a whole. A share price that moves exactly in line with the market has a beta of 1.

A stock with a beta of 1.2 would rise by 12% if the market rose by 10%, and fall by 12% if the market fell by 10%. CAPM tells us it is only possible to earn higher returns than those of the market as a whole by assuming a higher risk (beta).

We can assist with your CAPM model assignment

Our service provides assistance with any finance topic at any academic level. That includes CAPM model assignment help and MM model assignment help. It is difficult to understand the capital asset pricing model and classroom instructors don’t always have time to make sure every student grasps the concept. Our service can provide the extra help you need to understand this and other difficult finance topics. Services we provide aren’t limited to homework assignments. We offer test preparation, research paper assistance and individual tutoring services on specific topics as well as for entire finance courses. Our goal isn’t just to make sure you submit the correct answers on an assignment. We want you to understand how an answer was arrived at and why it was done in a particular way. In order to achieve this we provide detailed explanations for every step in a finance problem to ensure complete understanding.

We provide the best CAPM model assignment help

The help you receive with your CAPM model assignment and other finance topics comes from experts in the field. Every finance tutor online we work with has a degree in finance or related fields, even at the graduate level. They also have extensive finance tutoring experience, and the ability to explain difficult ideas and concepts in a way that is easy to understand. Our tutors take pride in what they do and are committed to ensuring you completely understand any topic they assist you with. Commitment, academic prowess and experience make them the best available finance tutors available.

Our service comes with benefits

The first priority of our service is providing outstanding finance homework assistance but we offer more. Additional benefits of our service include:

- Guarantees of full satisfaction with all work we provide

- Affordable rates that can be managed on a student’s budget

- Easy online order and payment process

- Live customer support 24/7